If you own your own truck and operate under your own authority (or are leased to a carrier), owner-operator insurance is your most important business expense. With 2026 trucking insurance Ontario rates reflecting continued market tightening, securing the right coverage matters more than ever. Unlike company drivers who are covered under their employer's policy, you're responsible for securing all your own coverage—and a single uninsured accident could cost you your truck, your savings, and your livelihood.

Comprehensive insurance creates a protective shield around your trucking business

What Is Owner Operator Insurance?

Owner-operator truck insurance is a specialized commercial auto policy designed for independent truckers who own their equipment and operate under their own Motor Carrier (MC) number or are leased onto a carrier. It's different from standard commercial truck insurance because it accounts for the unique risks of running your own trucking business.

Owner Operator Insurance Typically Includes:

- Primary Liability ($2M minimum in Ontario) — Covers bodily injury and property damage you cause to others

- Physical Damage — Protects your truck against collision, fire, theft, and vandalism

- Cargo Insurance — Covers the freight you're hauling if it's damaged or stolen

- Non-Trucking Liability (Bobtail) — Coverage when you're not under dispatch

- Uninsured/Underinsured Motorist — Protection if you're hit by someone without adequate coverage

As an owner-operator in Ontario, you'll also need a valid CVOR (Commercial Vehicle Operator's Registration) and must maintain your insurance certificates on file with the Ministry of Transportation. Your insurance policy must be with a carrier licensed to operate in Ontario.

Keep your insurance certificates and policy documents accessible at all times

Owner-operator insurance provides comprehensive protection for your truck and business

Why Do You Need Owner Operator Insurance?

It's Legally Required

Ontario law requires all commercial vehicles over 4,500 kg to carry minimum $2M liability coverage. Operating without insurance can result in fines up to $50,000 and loss of your CVOR.

Protect Your Investment

Your truck is likely worth $80,000-$200,000+. Physical damage coverage ensures a fire, accident, or theft doesn't wipe out your entire business investment overnight.

Shipper Requirements

Most brokers and shippers require proof of insurance before giving you loads. Without proper coverage, you can't access the freight market.

Personal Asset Protection

"Nuclear verdicts" (multi-million dollar jury awards) are increasingly common in trucking accidents. Adequate liability coverage protects your home, savings, and future earnings.

Warning: New Authority Penalties

If you're a new owner-operator (less than 2 years experience), expect to pay 40-60% more for insurance. Many insurers won't cover new authorities at all. Work with a truck insurance broker who specializes in new ventures—they know which trucking insurance companies will write your policy.

How Much Does Owner Operator Insurance Cost?

The average owner-operator in Ontario pays $8,000 to $15,000 per year for comprehensive coverage. Your actual premium depends on several factors:

| Factor | Impact on Premium |

|---|---|

| Driving Experience | New drivers pay 40-60% more; 5+ years reduces rates |

| CVOR Status | "Conditional" rating adds 35-50% to premiums |

| Claims History | Each at-fault claim can add 15-30% for 3-6 years |

| Operating Radius | Cross-border adds 25-50%; local is cheapest |

| Cargo Type | Hazmat, heavy haul, and reefer cost more |

| Truck Value | Newer, more expensive trucks cost more to insure |

| Deductible Choice | Higher deductible = lower premium (but more out-of-pocket) |

Typical Annual Premium Breakdown:

Real Claim Examples

Understanding how insurance works in practice helps you appreciate why proper coverage matters. Here are three real scenarios from Ontario owner-operators:

Rear-End Collision on Highway 401

An owner-operator was hauling a load of auto parts when traffic suddenly stopped near Milton. Despite hard braking, he rear-ended the vehicle ahead, causing $180,000 in property damage and $95,000 in injuries to the other driver.

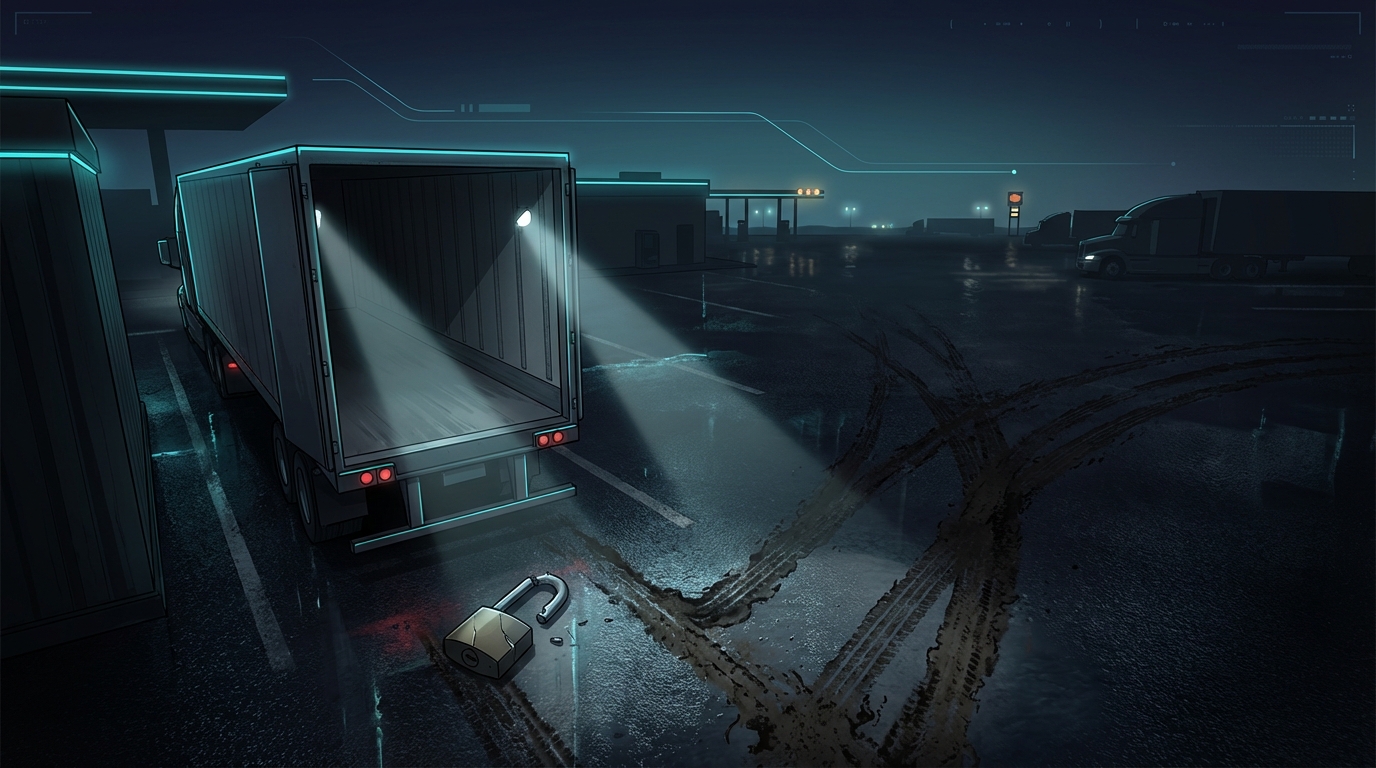

Cargo Theft at Truck Stop

While stopped overnight at a rest area near London, thieves broke into the trailer and stole $85,000 worth of electronics. The owner-operator had proper cargo insurance with theft coverage.

Engine Fire in Brampton

A mechanical failure caused an engine fire that totaled the owner-operator's 2019 Freightliner Cascadia. The truck was valued at $125,000 and was the driver's sole source of income.

Tips to Lower Your Premiums

Safety technology like dashcams and ELDs can qualify you for insurance discounts

Maintain a Clean CVOR

Your safety rating directly affects premiums. Fix violations promptly and fight unfair tickets. A "Satisfactory" rating can save you 20-40% compared to "Conditional."

Install Safety Technology

Dash cams, ELDs, and collision avoidance systems can qualify you for discounts of 5-15%. Plus, dash cam footage can protect you from fraudulent claims.

Take Safety Courses

Completing recognized safety training programs (like PMTC or Truck Training Schools Association courses) can reduce premiums by 5-10%.

Choose Higher Deductibles

Increasing your physical damage deductible from $1,000 to $2,500 can reduce that portion of your premium by 15-25%. Just make sure you can afford the out-of-pocket cost.

Shop Around Annually

Insurance markets change constantly. Get quotes from 3-5 brokers at each renewal. Even experienced drivers can save $1,000-$2,000 by switching carriers.

Industry Classification Codes

Insurance premiums are determined by your operation's classification codes. Owner-operators typically fall under NAICS 484121 (General Freight Trucking, Long-Distance) with corresponding WSIB and ISO codes that affect your workers' compensation and liability rates.

Ontario Trucking Insurance Classification Reference

Cross-reference table for NAICS, WSIB, ISO, and NCCI codes

| Category | NAICS (i) | WSIB (i) | ISO (i) | Risk Level | Avg. Premium |

|---|---|---|---|---|---|

| General Freight Trucking, Long-Distance Long-haul trucking operations exceeding 150km radius | 484121 | 70220 | CA 7219 | High | $12,000 - $18,000/year |

| General Freight Trucking, Local Local delivery within 150km radius | 484110 | 70210 | CA 7218 | Medium | $6,000 - $10,000/year |

| Specialized Freight - Refrigerated Temperature-controlled cargo transport | 484230 | 70230 | CA 7228 | High | $14,000 - $22,000/year |

| Specialized Freight - Flatbed/Heavy Haul Oversized loads, machinery, construction equipment | 484220 | 70230 | CA 7222 | Very High | $18,000 - $28,000/year |

Note: Premium estimates are based on 2024 Ontario market rates for operators with clean CVOR records. Actual premiums vary based on experience, claims history, fleet size, and cargo type. Get a personalized estimate →

Get Your Owner Operator Insurance Quote

Free quotes from licensed Ontario brokers

Frequently Asked Questions

Can I get owner-operator insurance with no experience?

Yes, but it's challenging and expensive. Most major insurers require 2+ years of verifiable experience. Specialized "new venture" insurers will write policies for new owner-operators, but expect to pay 40-60% more. Working with a broker who specializes in trucking insurance is essential—they know which carriers accept new authorities.

What's the difference between being leased-on vs. having your own authority?

If you're leased onto a carrier, they typically provide primary liability coverage and you need "non-trucking liability" (bobtail) plus physical damage. If you have your own MC authority, you need a full commercial policy with primary liability, cargo, and physical damage—which is more expensive but gives you more control over your business.

Do I need cargo insurance if I'm leased to a carrier?

Usually no—the carrier's policy covers cargo while you're under dispatch. However, you should verify this with your carrier and get it in writing. Some owner-operators carry their own cargo policy for additional protection or to haul loads outside their lease agreement.

What happens if I have an accident and don't have enough coverage?

You're personally liable for any damages exceeding your policy limits. In Ontario, this means creditors can pursue your personal assets—home, savings, future earnings. With "nuclear verdicts" sometimes exceeding $10M, carrying only the minimum $2M liability is risky for serious accidents.

Can I insure multiple trucks as an owner-operator?

Yes, and you should. Once you have 2+ trucks, you qualify for fleet insurance, which typically saves 15-25% per truck compared to individual policies. Even with just 2 trucks, ask your broker about fleet rates.