Many owner-operators and small fleets regularly pull trailers owned by shippers, carriers, or logistics companies. If that trailer is damaged, stolen, or destroyed while in your possession, you're financially responsible. With trailer values climbing through 2026, trailer interchange insurance protects you from potentially devastating losses on equipment you don't own.

Trailer interchange operations are common in modern logistics, creating exposure to non-owned equipment

What Is Trailer Interchange Insurance?

Trailer interchange insurance provides physical damage coverage for non-owned trailers that you pull under a written trailer interchange agreement. It's essentially physical damage coverage (collision and comprehensive) for trailers belonging to someone else.

Trailer Interchange Typically Covers:

- Collision Damage — When the non-owned trailer is damaged in an accident

- Comprehensive Losses — Fire, theft, vandalism, weather damage to the trailer

- Overturning — Damage from rollovers or jackknifes affecting the trailer

- Loading/Unloading Damage — Damage occurring at pickup or delivery (varies by policy)

Interchange Agreement Required

Most trailer interchange policies only apply when there's a written trailer interchange agreement between you and the trailer owner. If you're informally pulling someone's trailer without a formal agreement, you may not be covered. Always get agreements in writing.

Why Do You Need Trailer Interchange Insurance?

Your Policy Won't Cover It

Your physical damage policy covers YOUR trailers, not trailers owned by others. Without trailer interchange coverage, you're personally liable for any damage to non-owned trailers.

Interchange Agreements Require It

Many shippers and carriers require proof of trailer interchange insurance before letting you pull their equipment. No coverage means no loads.

Trailers Are Expensive

A new dry van trailer costs $30,000-$50,000. Refrigerated trailers run $60,000-$80,000+. One total loss could bankrupt your operation.

Theft Happens

Trailer theft is common, especially for loaded trailers. If a trailer is stolen while in your possession, you could be held responsible for its full value.

How Much Does Trailer Interchange Insurance Cost?

Trailer interchange insurance is relatively affordable, typically costing $300 to $1,200 per year depending on coverage limits and how often you pull non-owned trailers.

| Coverage Limit | Annual Premium |

|---|---|

| $25,000 | $300 – $500 |

| $50,000 | $400 – $700 |

| $75,000 | $600 – $900 |

| $100,000 | $800 – $1,200 |

Factors Affecting Your Rate:

Real Claim Examples

Trailer interchange claims are more common than you might think. Here are three scenarios where this coverage protected Ontario truckers:

Fire Destroys Interchanged Trailer

An owner-operator was pulling a trailer belonging to a major carrier under a trailer interchange agreement. While parked overnight at a truck stop near Kingston, an electrical fire in the trailer's wiring system caused $45,000 in damage. The trailer was owned by the carrier, not the driver.

Jackknife Damages Shipper's Trailer

During a winter storm on Highway 401, an owner-operator jackknifed while pulling a customer's trailer. The trailer suffered $28,000 in damage including bent doors, damaged flooring, and structural issues. The shipper demanded compensation for their trailer.

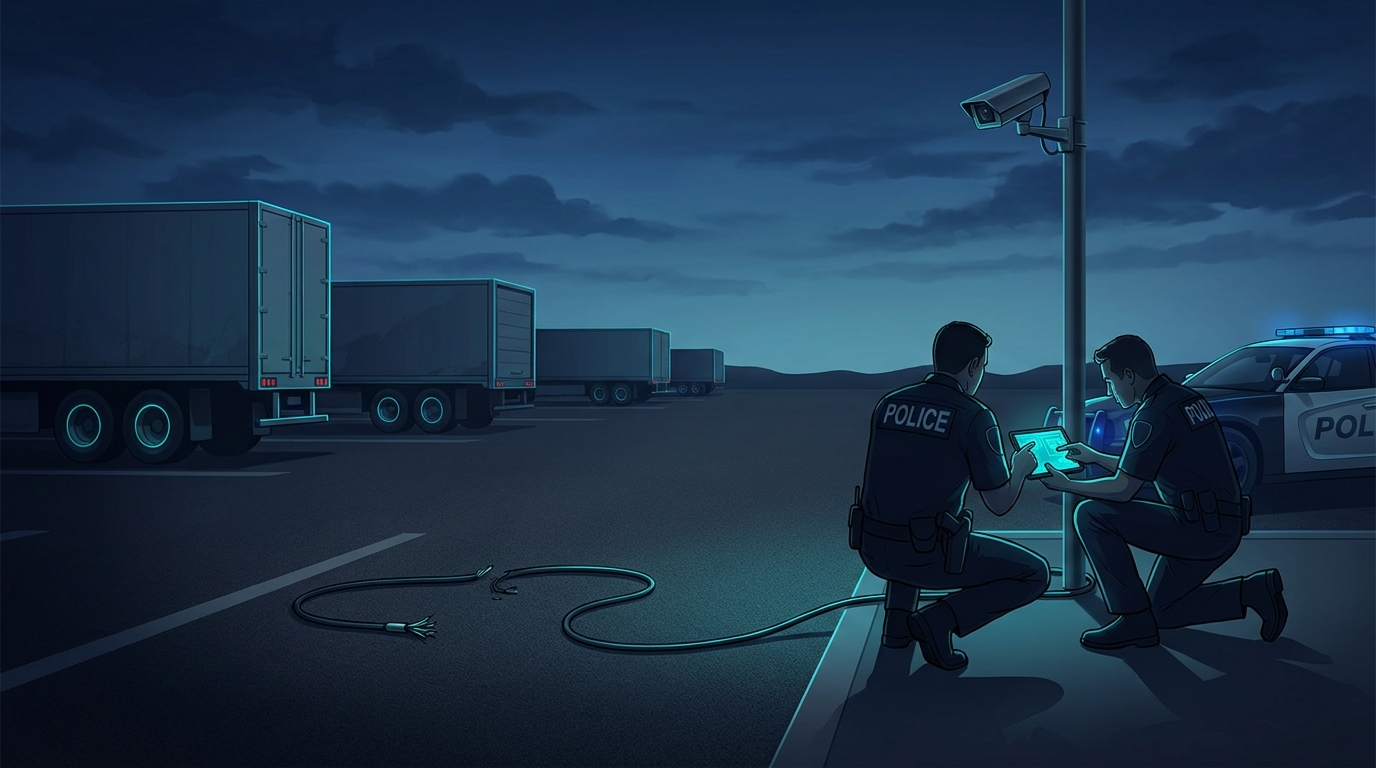

Stolen Trailer at Rest Area

An owner-operator stopped overnight at a rest area with a loaded trailer belonging to a logistics company. By morning, the trailer had been stolen. The trailer itself was valued at $35,000. The cargo was covered separately, but the trailer owner demanded payment for their equipment.

Tips for Trailer Interchange Coverage

Match Coverage to Trailer Values

If you regularly pull reefer trailers worth $70,000+, don't buy $25,000 in coverage. Ensure your limits match the maximum value of trailers you'll be pulling.

Get Interchange Agreements in Writing

Your coverage may only apply with a written interchange agreement. Always document the arrangement with the trailer owner, even for regular shippers.

Inspect Before Hooking Up

Document any existing damage before taking possession of a trailer. Photos protect you from being blamed for pre-existing damage.

Understand Exclusions

Most policies exclude mechanical breakdown, wear and tear, and damage from improper loading. Know what's not covered so you can take precautions.

Bundle with Physical Damage

Many insurers offer trailer interchange as an add-on to your physical damage policy. Bundling often saves money compared to standalone coverage.

Industry Classification Codes

Trailer interchange coverage rates are determined by operation type. Classifications use NAICS codes (484110 for local, 484121 for long-distance) with corresponding WSIB and ISO ratings.

Ontario Trucking Insurance Classification Reference

Cross-reference table for NAICS, WSIB, ISO, and NCCI codes

| Category | NAICS (i) | WSIB (i) | ISO (i) | Risk Level | Avg. Premium |

|---|---|---|---|---|---|

| General Freight Trucking, Long-Distance Long-haul trucking operations exceeding 150km radius | 484121 | 70220 | CA 7219 | High | $12,000 - $18,000/year |

| General Freight Trucking, Local Local delivery within 150km radius | 484110 | 70210 | CA 7218 | Medium | $6,000 - $10,000/year |

| Specialized Freight - Refrigerated Temperature-controlled cargo transport | 484230 | 70230 | CA 7228 | High | $14,000 - $22,000/year |

| Specialized Freight - Flatbed/Heavy Haul Oversized loads, machinery, construction equipment | 484220 | 70230 | CA 7222 | Very High | $18,000 - $28,000/year |

Note: Premium estimates are based on 2024 Ontario market rates for operators with clean CVOR records. Actual premiums vary based on experience, claims history, fleet size, and cargo type. Get a personalized estimate →

Get Your Trailer Interchange Insurance Quote

Free quotes from licensed Ontario brokers

Frequently Asked Questions

What's the difference between trailer interchange and non-owned trailer coverage?

Trailer interchange requires a written interchange agreement between you and the trailer owner. Non-owned trailer coverage (also called "hired auto physical damage") may cover trailers you rent or borrow without a formal interchange agreement. Some policies combine both; check your specific coverage.

Does trailer interchange cover the cargo inside?

No. Trailer interchange only covers physical damage to the trailer itself. The cargo is covered under your motor truck cargo insurance policy, which is separate coverage.

Am I covered if the trailer has mechanical problems?

Generally no. Mechanical breakdown, wear and tear, and gradual deterioration are typically excluded. The coverage is for sudden, accidental damage like collisions, fire, or theft—not maintenance issues.

Does the trailer owner's insurance cover me?

Usually not for physical damage. While the trailer owner may have their own insurance, interchange agreements typically make you responsible for damage while the trailer is in your possession. Their insurance may be secondary or may not apply at all.

How much coverage do I need?

Get enough to cover the most valuable trailers you'll pull. Dry vans typically run $30,000-$50,000; refrigerated trailers cost $60,000-$80,000+. If you regularly pull reefers, $75,000-$100,000 coverage is wise.