How Much Cargo Insurance Do I Need?

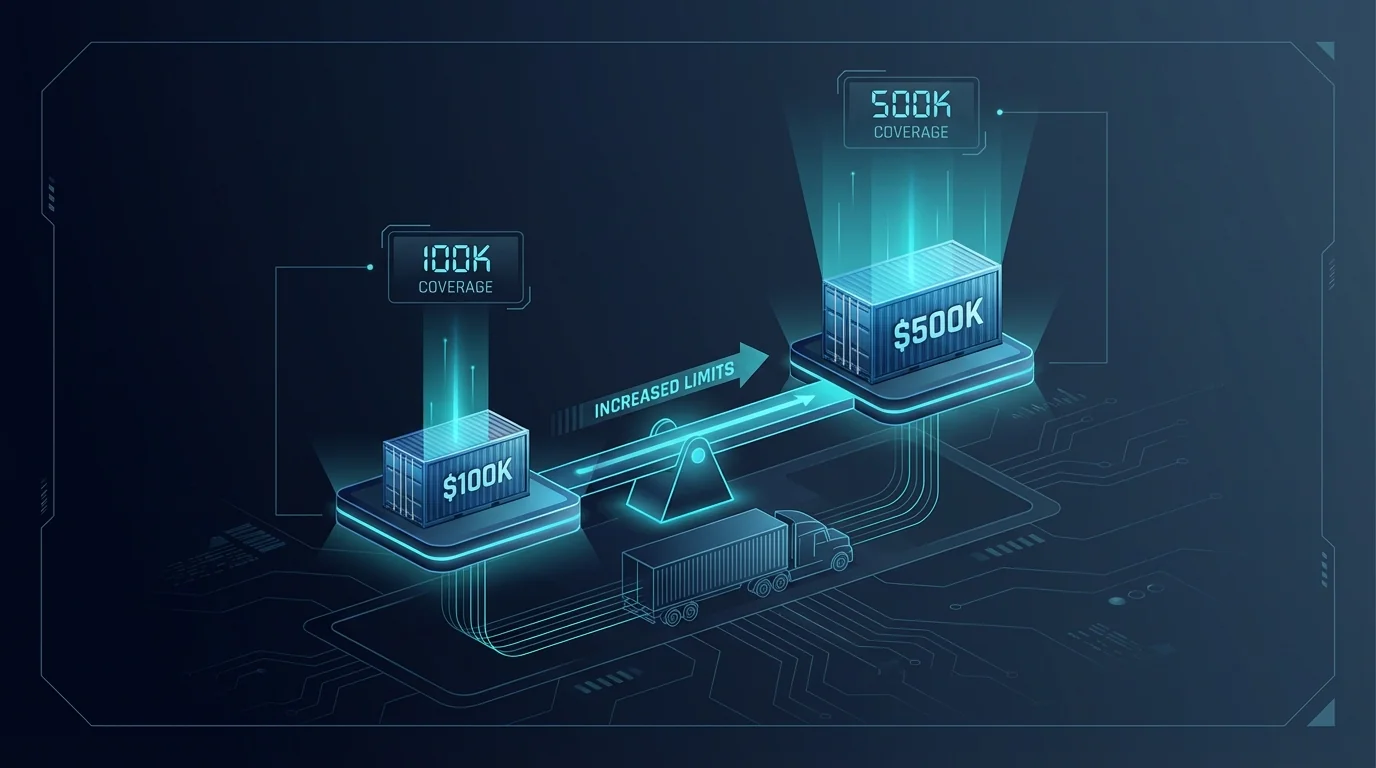

The right cargo insurance limit depends on what you haul. In 2026, most general freight carriers still need $100,000 minimum, but high-value commodities require significantly more. Here's how to determine your coverage needs.

Last updated: February 2026 | Cargo coverage guide

Quick Guide: Cargo Limits by Freight Type

Understanding Cargo Insurance Requirements

While Ontario doesn't legally require cargo insurance, you won't haul freight without it. Every shipper and freight broker will require proof of cargo coverage before booking you. Here's how to determine the right limit:

The Golden Rule

Your cargo limit should equal or exceed the maximum value of any single load you haul. If you haul a $150,000 load of electronics with only $100,000 in coverage, you're personally liable for the $50,000 difference if the load is lost.

| Cargo Type | Recommended Limit | Typical Premium | Notes |

|---|---|---|---|

| General Freight | $100,000 | $400 - $800/yr | Industry standard minimum |

| Refrigerated/Reefer | $100,000 - $150,000 | $600 - $1,200/yr | Includes reefer breakdown |

| Electronics | $250,000 - $500,000 | $1,500 - $3,000/yr | High theft target |

| Pharmaceuticals | $250,000 - $500,000 | $2,000 - $4,000/yr | Temperature controlled |

| Alcohol/Tobacco | $200,000 - $300,000 | $1,800 - $3,500/yr | Restricted cargo, higher rates |

| Household Goods | $100,000 - $250,000 | $800 - $1,500/yr | Claims-prone category |

| Machinery/Equipment | $100,000 - $500,000 | $1,000 - $2,500/yr | Varies by equipment value |

What Cargo Insurance Covers (and Doesn't)

Covered Losses

- Collision damage: Freight damaged in an accident

- Theft: Cargo stolen from your truck or trailer

- Fire: Freight destroyed by fire

- Weather: Damage from storms, flooding

- Overturning: Cargo damage from rollover accidents

Exclusions (Not Covered)

- Delay: Economic losses from late delivery

- Rejected freight: Receiver refuses undamaged cargo

- Inherent vice: Natural deterioration of goods

- Improper loading: If YOU loaded incorrectly (shipper-load may be covered)

- Mysterious disappearance: Shortage without evidence of theft

- Nuclear/war: Standard policy exclusions

Reefer Breakdown Coverage

If you haul temperature-sensitive freight, make sure your policy includes reefer breakdown coverage. Standard cargo policies may exclude spoilage caused by mechanical failure of your refrigeration unit. This coverage typically adds $200-400/year to your premium.

What Shippers and Brokers Require

Different freight sources have different requirements:

Load Boards (DAT, Truckstop)

- • Minimum $100,000 cargo coverage

- • Must be listed on your Certificate of Insurance

- • Some brokers require $250,000+

Major Shippers (Direct)

- • Often require $100,000 - $250,000

- • May require them as Additional Insured

- • 30-day cancellation notice required

Amazon Relay

- • $100,000 minimum cargo coverage

- • Must include theft coverage

- • Certificate must list Amazon as interested party

High-Value Freight

- • Electronics/pharma: $250,000+

- • May require GPS tracking proof

- • Background checks on drivers

How to Avoid Being Underinsured

- Know your highest-value load: Before setting your limit, determine the most expensive cargo you'll haul.

- Read the rate confirmation: Some loads have cargo value declarations. Don't haul $200K loads with $100K coverage.

- Consider excess cargo coverage: If you occasionally haul high-value freight, excess cargo policies can provide additional limits.

- Review annually: As your business grows, your cargo needs may change.

Cargo Insurance Cost Factors

Your cargo premium is based on:

- Limit selected: Higher limits = higher premium

- Commodity type: High-risk cargo costs more to insure

- Deductible: Higher deductibles reduce premium

- Claims history: Prior cargo claims increase rates

- Geographic area: High-theft areas cost more